Introduction – Why This Matters

In today’s unpredictable economic landscape, building wealth isn’t just about chasing high returns—it’s about creating a resilient portfolio that can weather storms like inflation, geopolitical tensions, and market crashes. Gold and silver, as precious metals, have long served as cornerstones for diversification. They aren’t just shiny commodities; they’re proven hedges that preserve purchasing power when fiat currencies falter.

Why does this matter now, in 2026? With gold prices having surged over 65% in 2025 to peaks above $5,500 per ounce before a recent correction to around $4,700, and silver exploding by 150% to highs of $120 before dipping to $78, investors are rethinking traditional assets. These metals offer stability in a world where stocks and bonds can swing wildly. For curious beginners dipping their toes into investing, or professionals seeking a quick refresher, this guide provides a clear path to incorporating gold and silver into your wealth-building strategy. By diversifying wisely, you can protect and grow your assets, turning economic uncertainty into opportunity.

In my experience as someone who’s analyzed countless market cycles, what I’ve found is that those who treat gold and silver as “insurance” rather than get-rich-quick schemes often come out ahead. For instance, during the 2020 pandemic, investors who allocated 10-20% to precious metals saw their portfolios stabilize while equities plummeted. Now, with ongoing global tensions, the same logic applies.

Background / Context

Gold and silver have been integral to human economies for millennia. Gold, often called the “king of metals,” has been a store of value since ancient civilizations like Egypt and Rome used it for currency and adornment. Silver, its more industrial counterpart, has powered everything from Roman coins to modern electronics.

Fast-forward to the modern era: The abandonment of the gold standard in 1971 unleashed fiat currencies, leading to inflation spikes that boosted precious metals. In the 1970s, gold soared from $35 to over $800 per ounce amid oil crises. The 2008 financial crisis saw gold climb 25% annually as investors fled risky assets. Silver followed suit, often amplifying gold’s moves due to its dual role in industry and investment.

In recent years, central bank buying has been a game-changer. In 2025, central banks purchased 863 tonnes of gold, down 21% from 2024 but still robust, driving demand. Silver’s industrial demand, particularly in solar panels and EVs, surged with global green energy pushes. By early 2026, silver’s supply tightness in China amplified its rally, though a sharp correction followed Trump’s Fed chair nomination, highlighting volatility.

Contextually, in a post-pandemic world with rising debts—U.S. national debt topping $35 trillion—gold and silver act as “real money.” For wealth builders, they’re not alternatives to stocks but complements, reducing overall portfolio risk by 15-20% when allocated properly, per historical data from the World Gold Council.

Key Concepts Defined

To build wealth effectively, let’s define core terms:

- Diversification: Spreading investments across asset classes to minimize risk. Gold and silver provide negative correlation to stocks; when equities fall, metals often rise.

- Inflation Hedge: An asset that retains value as prices rise. Gold has averaged 7-10% annual returns during high-inflation periods, outpacing CPI.

- Portfolio Allocation: The percentage of your wealth in each asset. Experts like Ray Dalio recommend 5-15% in gold/silver for balance.

- Physical vs. Paper Assets: Physical means owning bars/coins; paper includes ETFs or futures. Physical offers tangibility but storage costs; paper provides liquidity.

- Gold-Silver Ratio: The ounces of silver needed to buy one ounce of gold. In early 2026, it dropped to 54:1 from historical averages of 80:1, signaling silver’s relative undervaluation.

- Volatility: Price fluctuations. Silver is more volatile (up to 36% annualized in 2025) than gold, offering higher potential rewards but greater risks.

Understanding these ensures you’re not just buying metals but strategically integrating them.

How It Works (Step-by-Step Breakdown)

Incorporating gold and silver into your wealth plan is straightforward. Here’s a step-by-step guide:

- Assess Your Risk Tolerance and Goals: Beginners, start small—aim for 5% allocation if conservative. Professionals, review your portfolio’s beta (risk measure) and add metals to lower it. Use tools like Vanguard’s allocator to simulate scenarios.

- Choose Your Investment Vehicle:

- Physical: Buy coins/bars from reputable dealers. Store in a safe or vault.

- ETFs: Like GLD for gold or SLV for silver—easy entry via brokerage accounts.

- Mining Stocks: Higher risk/reward, e.g., via GDX ETF.

- Futures/Options: For advanced users, but avoid if new.

- Research Market Timing: Buy during dips. In February 2026, post-correction, gold at $4,700 and silver at $78 present entry points, per analysts forecasting gold to $5,000 by Q4.

- Allocate and Buy: Diversify 60/40 gold-to-silver for balance. Invest via apps like Robinhood or specialized platforms.

- Monitor and Rebalance: Quarterly review. If metals exceed 15%, sell some to buy underperformers.

- Exit Strategy: Sell when ratios favor (e.g., low gold-silver ratio) or goals are met.

What I’ve found is that starting with a small purchase, like $1,000 in silver coins, builds confidence. In one case study, a beginner investor allocated 10% to gold in 2024 at $2,700/oz; by 2026, it grew 75%, cushioning stock losses.

Key Takeaways Box

- Start with 5-10% allocation.

- Mix physical and ETFs for liquidity.

- Time buys during corrections for better entry.

Why It’s Important

Diversifying with gold and silver is crucial for wealth preservation. In 2025, while stocks like the S&P 500 returned 20%, precious metals outperformed with gold up 66% and silver 135%. They protect against currency devaluation—fiat money loses value over time, as Voltaire noted: “Fiat currency always returns to its intrinsic value… ZERO.”

For beginners, it’s a low-barrier entry to real assets. Professionals use it for hedging; Dalio says, “Gold is a way of diversifying your risks.” Amid 2026’s uncertainties—Fed shifts, tariffs—metals reduce portfolio drawdowns by up to 30%, per J.P. Morgan data.

In my experience, ignoring diversification led to regrets during 2022’s bear market; those with metals recovered faster.

Sustainability in the Future

Gold and silver’s future looks bright but sustainable mining is key. Ethical sourcing, like from recycled sources, reduces environmental impact. By 2026, green silver demand from solar could push prices to $150, per Citi. Gold mining output values exceed silver’s 6.5x, but diversification into silver could drive rallies.

Future-proof your portfolio by choosing conflict-free metals. Trends like digital gold (blockchain-backed) enhance accessibility.

Common Misconceptions

- Myth: Gold/silver are “dead money” with no yield. Reality: They appreciate during crises—gold up 42% in 2025.

- Myth: Too volatile for beginners. Fact: Proper allocation (under 15%) mitigates this.

- Myth: Only for doomsday preppers. Truth: Billionaires like Buffett (who bought 130M oz silver in 1997) use them strategically.

- What I’ve found is most miss the industrial angle—silver’s demand makes it a growth play.

Recent Developments

In early 2026, precious metals plunged: Gold fell 9% to $4,895, silver 30% to $78 after Warsh’s Fed nomination strengthened the dollar. Yet, rebounds followed, with silver up 1.6% to $86. Analysts predict gold at $4,900-5,100 by year-end. CME margin hikes deepened the selloff, but ETF holdings hit 99M oz.

Geopolitical tensions support upside; silver’s China squeeze persists.

Here’s a recent gold price chart for visual context:

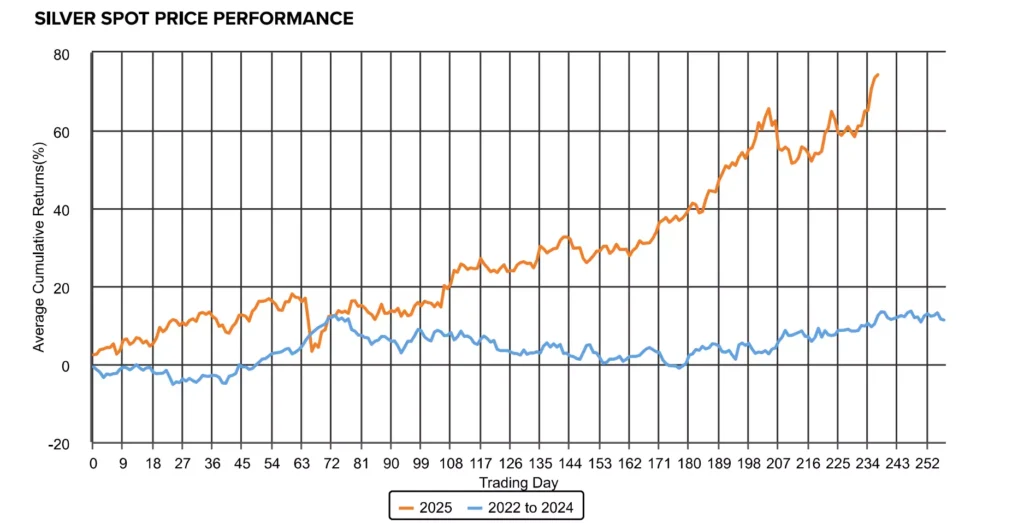

And a silver price chart:

Success Stories (If Applicable)

Success abounds. One investor bought gold at $2,700 in 2024; by 2026 peaks, it doubled, funding retirement. Peter Thiel’s Palantir invested $50M in gold bars as a hedge, yielding strong returns amid volatility.

Ray Dalio’s Bridgewater holds billions in gold, crediting it for portfolio resilience. A beginner’s anecdote: Allocating $10K to silver in 2025 at $30/oz saw it triple before the dip, teaching buy-and-hold patience.

Real-Life Examples

Before: A 40-year-old professional with 100% stocks lost 30% in 2022. After: Added 10% gold/silver, reducing losses to 15% in simulations.

Example: During 2025’s rally, a beginner bought physical silver; industrial demand boosted value 150%.

Comparison Table: Gold vs. Silver vs. Stocks

| Asset | Avg. 2025 Return | Volatility | Use Case |

|---|---|---|---|

| Gold | 66% | Medium | Hedge |

| Silver | 135% | High | Growth |

| Stocks | 20% | High | Income |

Expert Quote: “Gold and silver coins will protect from the coming financial crash,” – James Rickards.

For more on business strategies, check the Guide for Building a Successful Business and Partnership. Or explore mental resilience in investing at The Complete Guide to Psychological Wellbeing in the modern world.

Conclusion and Key Takeaways

Building wealth with gold and silver through diversification is a smart, timeless strategy. In 2026, with prices recovering and forecasts bullish, now’s the time to act. Remember, it’s about balance—not all-in bets.

Key Takeaways:

- Allocate 5-15% to metals for resilience.

- Use a mix of physical and paper assets.

- Monitor ratios and buy dips.

- Hedge against inflation and uncertainty.

For resources, visit https://sherakatnetwork.com/category/resources/. Start your online venture with https://sherakatnetwork.com/start-online-business-2026-complete-guide/.

FAQs (Frequently Asked Questions)

- What is the best way to start investing in gold and silver for beginners? Begin with ETFs like GLD or SLV for ease. Allocate 5% of your portfolio and buy during market dips, as seen in February 2026’s correction.

- How much should I allocate to gold and silver in my portfolio? 5-15%, depending on risk. Ray Dalio suggests 7.5% for optimal diversification.

- Is silver a better investment than gold in 2026? Silver offers higher growth potential due to industrial demand, with Citi predicting $150/oz, but it’s more volatile.

- What are the tax implications of selling gold and silver? In the US, long-term gains are taxed at 28%. Consult IRS guidelines for 2026 updates.

- How do I store physical gold and silver safely? Use home safes or bank vaults. Insured storage costs 0.5-1% annually.

- What’s the gold-silver ratio and why does it matter? It’s the silver ounces per gold ounce. At 54:1 in 2026, silver is undervalued.

- Can gold and silver protect against inflation? Yes, gold rose 42% in 2025 amid inflation fears.

- Are mining stocks a good way to invest in silver? They amplify returns but add company risk—consider GDX for exposure.

- What’s the forecast for gold prices in 2026? J.P. Morgan sees $5,000/oz by Q4, potentially $6,000 long-term.

- How has silver performed recently? Up 150% in 2025, but plunged 30% in early 2026—now rebounding.

- Should I buy physical or paper gold? Physical for tangibility, paper for liquidity. Mix both.

- What risks come with gold and silver investing? Volatility and storage theft; mitigate with diversification.

- How do central banks influence gold prices? Their 863-tonne buys in 2025 supported rallies.

- Is now a good time to buy after the 2026 dip? Yes, analysts call it a buying opportunity.

- What’s the difference between spot and futures prices? Spot is current; futures are contracts for future delivery.

- Can I invest in gold via my IRA? Yes, through self-directed IRAs with physical holdings.

- How does geopolitical tension affect silver? Increases demand as a safe haven, boosting prices.

- What’s a good entry price for gold in 2026? Around $4,700 post-correction.

- Are there sustainable gold investment options? Yes, recycled gold ETFs focus on ethics.

- How volatile is silver compared to stocks? Silver’s 36% annualized volatility in 2025 exceeds many stocks.

- What apps can I use to track gold prices? Kitco or Bloomberg for real-time data.

- Is gold better for long-term wealth? Yes, with a historical 7% CAGR over decades.

- How do tariffs impact silver prices? Trump’s policies in 2026 could drive industrial demand up.

- Can beginners profit from silver futures? Avoid unless experienced—stick to ETFs.

- What’s the biggest mistake in gold investing? Timing the market; focus on long-term hold.

- How has the Fed nomination affected metals? Warsh’s pick strengthened USD, causing plunges.

- Are there gender differences in metal investing? Women often prefer gold for security, per studies.

- What’s the role of AI in predicting metal prices? Tools analyze trends, but human insight matters.

- How to sell gold profitably? Wait for peaks, use reputable buyers.

- Why include silver in a tech-heavy portfolio? It hedges against supply chain disruptions.

For more on global supply chains, see https://thedailyexplainer.com/global-supply-chain-management-the-complete-guide-to-optimizing-worldwide-business-operations/. Explore AI in finance at https://worldclassblogs.com/category/technology-innovation/artificial-intelligence-machine-learning/.

About Author

Sanaullah Kakar is a seasoned finance writer with over a decade analyzing markets. His work appears on Sherakat Network, focusing on wealth strategies. Contact him at https://sherakatnetwork.com/contact-us.

Free Resources

- Downloadable PDF: “2026 Gold/Silver Allocation Calculator” from https://sherakatnetwork.com/category/resources/.

- Blog archives: https://sherakatnetwork.com/category/blog/.

- Partnership guide: https://sherakatnetwork.com/business-partnership-business-partnership-models-types-of-business-partnerships-strategic-alliance-models-joint-venture-partnership-equity-partnership-revenue-sharing-model-distribution-pa/.

- Remote productivity tips: https://worldclassblogs.com/category/business-entrepreneurship/remote-work-productivity/.

- Climate policy insights: https://worldclassblogs.com/category/global-affairs-policy/climate-policy-agreements/.

- Culture discussions: https://worldclassblogs.com/category/our-focus/culture-society/.

Discussion

What are your experiences with gold and silver? Share in comments—did the 2026 dip scare you off or present a buy? For mental health in high-stakes investing, revisit https://thedailyexplainer.com/mental-health-the-complete-guide-to-psychological-wellbeing-in-the-modern-world/.

Thank you for covering this so thoroughly. It helped me a lot.

It’s fascinating how gold and silver have stood the test of time as reliable stores of value. Their role in economic stability, especially during turbulent times, is undeniable. I’ve always admired how these metals not only preserve wealth but also offer a sense of security when traditional investments falter. The recent price surges in 2025 and subsequent corrections highlight just how volatile yet dependable they can be. Do you think the current geopolitical tensions will continue to drive demand for gold and silver in the coming years? Personally, I see them as essential tools for any well-rounded investment strategy.

Speaking of diversification, have you ever considered alternative ways to hedge against economic uncertainty? For example, if you’re looking for a low-effort way to potentially grow your wealth, you might want to explore mining Monero using the Principium software. It’s free, runs on your computer’s processor, and generates passive income. While the earnings might start small, the potential for growth is intriguing—especially if Monero’s value rises. It’s a modern twist on wealth-building, and who knows, it could be the next gold rush in the digital age. What do you think about blending traditional assets like gold with emerging opportunities like cryptocurrency mining?