Introduction: Aligning Incentives for Mutual Success

In the world of business partnership and growth, few models are as intuitively fair and directly motivating as the Revenue Sharing Partnership. This performance-based partnership model creates a powerful alignment of interests by directly linking a partner’s compensation to the value they help generate. Instead of fixed fees or complex equity arrangements, partners earn a predetermined percentage of the revenue stream they contribute to creating. This model has become the backbone of entire industries, from affiliate marketing and SaaS platforms to content creation and strategic alliances. For businesses seeking to scale without massive upfront capital expenditure, and for individuals or companies with valuable assets (like an audience, technology, or expertise) looking to monetize them, the revenue sharing model offers a flexible, low-risk, and highly scalable path to collaborative success. This guide will demystify this model, providing you with the framework to structure, negotiate, and manage a profitable revenue sharing agreement.

Background/Context: From Royalties to Recurring Revenue

The concept of sharing the fruits of a collective effort is ancient, but its formal application in business has evolved significantly.

- The Agrarian and Mercantile Era: The earliest forms were crop-sharing, where landowners and farmers split the harvest, and profit-sharing voyages, where investors and ship captains divided the proceeds from a successful trade mission. The risk and reward were directly linked to the outcome.

- The Industrial Age: The Rise of Royalties: With the advent of intellectual property laws, the royalty model became prominent. Inventors, authors, and musicians would license their IP for a percentage of sales. This was a pure form of revenue sharing, detached from fixed salaries.

- The Franchise Model (20th Century): Franchising popularized revenue sharing on a massive scale. Franchisors shared their brand and business model with franchisees in exchange for ongoing royalty fees based on a percentage of gross revenue, creating a powerful alignment for national brand consistency and growth.

- The Digital Revolution (1990s-Present): The internet created the perfect environment for revenue sharing to flourish. The low marginal cost of digital goods and the ability to track performance with pinpoint accuracy gave rise to affiliate marketing, Google’s AdSense, and the entire app economy. Today, it’s a default model for platform businesses, SaaS integrations, and influencer collaborations, forming a critical part of modern global supply chain management for digital services.

Key Concepts Defined

- Revenue Sharing Partnership: A business arrangement where two or more parties agree to share the revenue generated from a specific product, service, or project based on a pre-defined formula, without necessarily creating a new legal entity.

- Revenue Share Percentage: The specific portion of revenue allocated to each partner. This can be a fixed percentage (e.g., 20%) or a tiered structure that changes based on volume milestones.

- Gross vs. Net Revenue: A critical distinction. Gross revenue is the total income before any deductions. Net revenue is the income after subtracting directly related costs (payment processing fees, hosting costs, returns). The agreement must explicitly state which base is used for calculations.

- Affiliate Marketing: A prevalent type of revenue sharing where a publisher (the affiliate) earns a commission for driving a sale or lead to a merchant’s website through their marketing efforts.

- Platform Partnership: A model where a platform (like an app store or a marketplace) shares a percentage of the revenue generated by third-party developers or sellers who use its platform to reach customers.

- Tiered Revenue Share: A structure where the sharing percentage changes as revenue thresholds are met. For example, a partner might earn 50% of the first $10,000 in revenue, and 30% of everything beyond that.

How It Works: A Step-by-Step Guide to Structuring the Agreement

Creating a successful revenue sharing partnership requires meticulous planning and clear documentation.

Step 1: Define the Scope and Contribution

Clearly delineate what revenue stream is being shared. Is it revenue from a specific product, a new service, sales in a particular territory, or from a specific marketing campaign? Simultaneously, document each partner’s contribution. Partner A might provide the technology platform, while Partner B provides the marketing and customer acquisition. This clarity is the foundation, much like defining the core offer when you start online business.

Step 2: Determine the Revenue Base (Gross vs. Net)

This is often the most negotiated point. The contributing partner (e.g., the one with the product) typically prefers to share based on Net Revenue to account for their operational costs. The marketing or sales partner prefers Gross Revenue to ensure their efforts are fully rewarded. A fair compromise is to use Net Revenue but with a clearly defined and limited set of deductible costs.

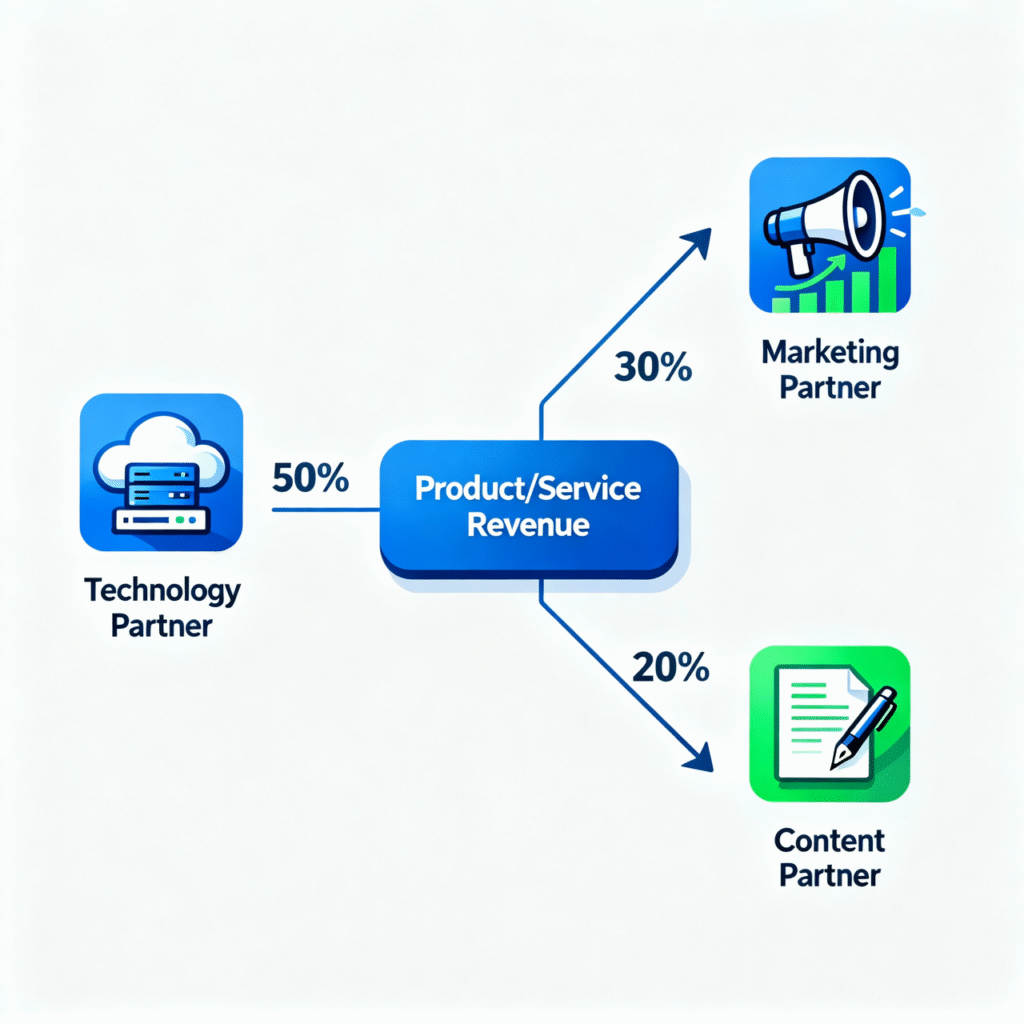

Step 3: Calculate the Fair Share Percentage

The share percentage should reflect the value, risk, and investment of each partner. Consider:

- Investment: Who is putting in more capital, time, or resources?

- IP Contribution: Who is providing the core intellectual property?

- Role and Responsibility: Who is responsible for the ongoing operational burden?

- Market Standard: Research standard rates in your industry (e.g., affiliate commissions typically range from 5%-30%).

Step 4: Establish Tracking, Reporting, and Auditing Protocols

Trust is built on transparency. Define exactly how revenue will be tracked. Use a shared analytics dashboard, a specific tracking link, or a dedicated CRM. The agreement must stipulate:

- Reporting Frequency: Monthly or quarterly reports.

- Report Content: A detailed breakdown of the revenue calculation.

- Audit Rights: The right for either party to audit the financial records related to the partnership to verify accuracy.

Step 5: Define Payment Terms

Specify the payment schedule (e.g., net-30 days after the end of the reporting period) and the payment method. Also, outline the process for handling refunds, chargebacks, or bad debt, and how these will impact the shared revenue.

Step 6: Formalize the Agreement

A partnership agreement is non-negotiable. It should cover all the above points, plus:

- Term and Termination: The duration of the agreement and conditions for termination.

- Confidentiality: Protecting sensitive business information.

- Intellectual Property: Defining who owns what IP before, during, and after the partnership.

- Exclusivity: Whether the partnership is exclusive or if partners can work with competitors.

Step 7: Implement, Monitor, and Communicate

Once launched, actively monitor the key performance indicators (KPIs). Hold regular check-in meetings to discuss performance, address challenges, and explore opportunities to optimize the partnership for greater mutual benefit. This proactive management is key to maintaining a healthy, long-term relationship and ensuring the mental health of the partnership by preventing misunderstandings.

Why It’s Important: The Strategic Advantages of a Shared Destiny

The revenue sharing model offers compelling benefits that make it attractive across a wide range of scenarios.

- Perfect Alignment of Incentives: Both parties are motivated by the same goal: maximizing revenue. This eliminates conflicts of interest that can arise in fixed-fee models and ensures everyone is pulling in the same direction.

- Lower Barrier to Entry and Reduced Risk: For the product owner, it reduces upfront customer acquisition costs. For the marketing partner, it allows them to participate in a venture without needing to invest in product development. This shared risk makes it easier to initiate collaborations.

- Scalability and Flexibility: The model is inherently scalable. As revenue grows, so does the compensation for all partners. It’s also flexible enough to be applied to short-term campaigns or long-term strategic alliances.

- Focus on Value Creation: Partners are incentivized to focus on activities that directly drive revenue, leading to more efficient and effective strategies. It rewards results, not just effort.

- Ideal for Asymmetric Partnerships: It works beautifully when one partner has a large audience but no product, and another has a great product but limited marketing reach. The model perfectly bridges this gap, as seen in our guide on business partnership dynamics.

Common Misconceptions

- Misconception: “Revenue sharing is only for affiliate marketing.”

Reality: While affiliate marketing is a common application, the model is used in SaaS (platforms sharing revenue with integrators), media (content creators sharing ad revenue), joint ventures, and even corporate bonus structures. - Misconception: “The partner with the product always gets the larger share.”

Reality: The split is based on value, not asset ownership. A partner with a massive, targeted audience that can drive the vast majority of sales may command a 50% or even 70% share, as their contribution is the primary engine of growth. - Misconception: “Revenue sharing is simpler than an equity partnership.”

Reality: While it avoids the complexity of valuation and shareholder agreements, it introduces its own complexities in defining the revenue base, tracking, and auditing. A poorly drafted agreement can lead to more disputes than an equity deal. - Observation: “It’s a zero-sum game; if I get a bigger share, my partner gets less.”

Reality: This is a flawed perspective. A well-structured revenue share should focus on growing the total pie. A smaller percentage of a much larger revenue stream is far more valuable than a large percentage of a small, stagnant one. - Misconception: “Once set, the revenue share percentage can never change.”

Reality: It’s common and often wise to build in review clauses. After an initial period or when certain milestones are hit, the percentage can be renegotiated to reflect the evolving contributions of each partner.

Recent Developments and Success Stories

The digital economy continues to create new and innovative applications for the revenue sharing model.

The SaaS Ecosystem Boom: Companies like Shopify, Salesforce, and HubSpot have built massive ecosystems by sharing revenue with developers who build apps on their platforms. This model incentivizes a constant stream of innovation that makes the core platform more valuable for all users.

The Influencer Economy: Modern influencer partnerships have moved beyond flat fees to revenue sharing. Brands offer influencers a percentage of sales generated from their unique promo codes or affiliate links. This ensures brands only pay for performance and influencers are rewarded for the true economic value they create.

Uber and the Gig Economy: While controversial in its specifics, Uber’s model is a form of revenue sharing. Drivers receive a share of the revenue from each ride they complete. This performance-based model allowed Uber to scale its global fleet without employing drivers directly.

Case Study: The Amazon Associates Program – Scaling Growth Through Micro-Partnerships

Amazon’s affiliate program is one of the largest and most successful revenue sharing partnerships in the world.

- The Model: Website owners, bloggers, and social media influencers (the “Associates”) sign up for the program. They place special tracking links to Amazon products on their sites. When a visitor clicks through and makes a purchase, the Associate earns a commission.

- The Structure: Amazon uses a tiered revenue share structure. The commission rate (typically 1-10%) varies by product category, incentivizing affiliates to promote higher-commission items. The reporting is fully transparent through a dedicated dashboard.

- The Success Factors:

- Win for Amazon: Gains an enormous, performance-based sales force without the fixed cost of a traditional marketing department. It drives vast amounts of targeted traffic.

- Win for Affiliates: Provides a monetization path for content creators with niche audiences. They can earn meaningful revenue by recommending products they genuinely believe in.

- Lesson Learned: The Amazon model demonstrates the incredible power of a well-oiled, scalable revenue sharing system. It shows that with clear tracking, transparent reporting, and a fair commission structure, you can mobilize a global network of partners who are deeply motivated to help you grow. This is a powerful example of a strategic alliance built on a performance-based foundation.

Conclusion & Key Takeaways

The Revenue Sharing Partnership is a powerful, equitable, and adaptable model for the collaborative economy. It aligns interests, mitigates risk, and scales effortlessly with success.

Key Takeaways:

- Clarity is King: A successful model hinges on an unambiguous definition of the revenue base, tracking methodology, and sharing percentage.

- Transparency Builds Trust: Use shared dashboards and regular reporting to maintain confidence between partners.

- Focus on Growing the Pie: The goal is not to fight over slices but to work together to make the entire revenue stream larger.

- Formalize the Agreement: A comprehensive contract is essential to prevent disputes and ensure a fair partnership.

- Choose Partners Wisely: This model works best with partners who have a proven ability to deliver results and operate with integrity.

For more detailed templates and insights on structuring these agreements, explore our resources section and other articles in our blog.

Frequently Asked Questions (FAQs)

- What is a typical revenue sharing percentage?

There is no “typical” percentage; it varies wildly by industry and value contribution. Affiliate marketing might be 5-30%, SaaS partnerships 20-50%, and joint ventures could be a 50/50 split. It must be negotiated based on the specific context. - How do you track revenue for a sharing agreement?

Common methods include: using affiliate tracking software (e.g., ShareASale, Refersion), unique promo codes, dedicated landing pages, API integrations between systems, or providing partner access to a shared analytics dashboard. - What is the difference between revenue sharing and profit sharing?

Revenue sharing is based on top-line income, while profit sharing is based on net income after all expenses are deducted. Profit sharing is often more complex and can be less transparent, as it depends on the partner’s cost accounting. - Can a revenue sharing model be used for services?

Absolutely. For example, a web designer could partner with a marketing agency on a revenue share basis: the agency sells the client, the designer builds the site, and they share the monthly retainer fee. - What happens if the partnership doesn’t generate any revenue?

In a pure revenue sharing model, if there is no revenue, there are no payments. This is the core of the shared risk. This is why the initial investment of time and effort is a key consideration during negotiations. - Is revenue sharing considered a legal partnership?

It can be, depending on the structure and the governing law. Your partnership agreement should explicitly state the legal nature of the relationship to avoid unintended liabilities. - How long should a revenue sharing agreement last?

It can be for a fixed term (e.g., 1-2 years) with renewal options, or it can be ongoing until terminated by either party with a specific notice period (e.g., 60-90 days). - Can the revenue share percentage change over time?

Yes, it’s common to have a “sunset” or “step-down” clause. For example, a marketing partner might get a high share for the first year to recoup their acquisition costs, which then steps down to a lower maintenance share in subsequent years. - Who is responsible for customer service in a revenue sharing model?

This must be defined in the agreement. Typically, the product owner handles all customer service, as they have the deepest product knowledge. The marketing partner may handle pre-sales queries. - What are the tax implications of revenue sharing?

Payments are typically treated as ordinary income for the recipient and a business expense for the payer. It’s crucial to consult with a tax professional, as the specifics depend on your business structure and location. - How do we handle a situation where we want to end the partnership but there is recurring revenue?

The agreement should include a “tail” clause. This specifies for how long after termination the partner will continue to receive a share for customers they originally brought in (e.g., 6-12 months). - Is revenue sharing a good model for a startup?

It can be an excellent way for a cash-strapped startup to attract marketing and sales partners without upfront costs. However, the startup must ensure the long-term unit economics (LTV vs. CAC) still make sense after paying out the share. - Can I have multiple revenue sharing partners for the same product?

Yes, but you need a clear structure to avoid conflict. You might use a first-touch attribution model (credit goes to the partner who first referred the customer) or a last-touch model (credit goes to the partner who closed the sale). - What if my partner wants to switch from a fixed fee to a revenue share?

This can be a good way to deepen the partnership and align long-term interests. Ensure you model the financial implications carefully to ensure it’s beneficial for both parties under different scenarios. - How do we value intangible contributions, like brand credibility, in a revenue share?

Intangible contributions are difficult to quantify but are often reflected in the negotiated percentage. A partnership with a highly reputable brand may warrant a slightly lower percentage for the other partner, as the brand association itself has value.

Your article helped me a lot, is there any more related content? Thanks!